Taxes, Simplified.

It’s not just about the numbers, it’s about you.

Ten years of Tax Preparation, E-File, and Bookkeeping services for individuals, families, and businesses.

Welcome to SGP Tax Services, llc, my name is Sherika Pearson and I’m here to provide real solutions for your tax needs. With a proven track record for getting the best possible outcome I invite your to read a few of my previous client reviews and testimonials.

What Do My Clients Say?

“Behind every successful business is clean, reliable bookkeeping.”

“We bring order to finances so you can focus on what you love.”

My Services

1040 Tax Preparation

End-to-end return preparation for individuals and businesses, including multi-state and federal filings, with personalized checklists to keep every detail on track.

Business Tax Preparation

Quarterly or annual planning sessions that align your financial goals with the latest tax opportunities, creating a roadmap designed to minimize liability and maximize cash flow.

Bookkeeping Service

Focus on accurately recording, organizing, and maintaining the businesses financial transactions so the business owner always knows where their money is and can make informed decisions. These services include: recording financial transactions, bank and credit card reconciliations, expense categorization, financial statement preparation, and sales tracking. These services are offered monthly, quarterly, and annually.

SGP Tax Service Commitment

Accurate, compliant, and long-term financial strategies is what you can expect from SGP Tax Services.

Pricing

Schedule Today

New to SGP?

Please fill out this secure intake form giving us an idea of your tax or bookkeeping needs. Once it’s received we will reach out to schedule your free consultation.

2025 Client Intake Form

Scan the QR code below to access the Client Intake Form or click here.

FAQ

Have more questions? Click the plus symbol to learn more.I’m Sherika G. Pearson, founder of SGP Tax Services LLC. What began as a commitment to helping families navigate tax season with clarity and confidence has evolved into a full-service approach centered on accuracy, strategy, and long-term financial stability. I specialize in individual and small business tax preparation, bookkeeping, compliance, and planning, with a focus on doing things correctly the first time—no shortcuts, no guesswork. My work is rooted in integrity, education, and empowerment, ensuring every client understands their numbers and their options. At SGP Tax Services, this isn’t just about filing returns—it’s about building wealth, protecting legacies, and creating peace of mind through informed financial decisions.

-

SGP Tax Services provides tax preparation, tax planning, and bookkeeping services for individuals, self-employed professionals, and small businesses.

Our focus is accuracy, compliance, and long-term financial strategy, not rushed or volume-based filing.

-

Pricing is based on complexity and scope, not just the number of forms. Final pricing is confirmed after intake review.

Tax Preparation – Starting Prices

Individual Tax Preparation → starting at $350

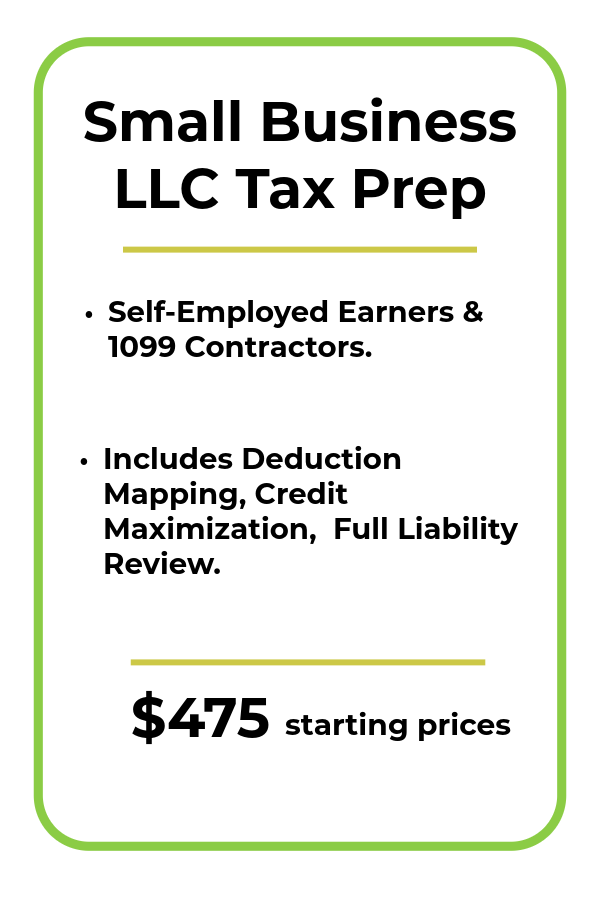

Self-Employed / 1099 Tax Preparation → starting at $475

Small Business / LLC Tax Preparation → starting at $475

Quarterly Tax Planning & Optimization Session → starting at $229

All services are invoiced and paid securely through Stripe once your intake is reviewed.

-

Yes. We offer ongoing bookkeeping services for clients who want consistent, organized financial records year-round.

Bookkeeping Plans

Monthly Bookkeeping → starting at $275/month

Quarterly Bookkeeping → starting at $475/quarter

Annual Bookkeeping Cleanup / Catch-Up → starting at $1,800/year

Bookkeeping pricing depends on:

Transaction volume

Number of accounts

Business structure

Prior record condition

Final pricing is confirmed after a brief review.

-

Complete the Tax or Bookkeeping Intake Form

Upload your documents

Complete payment via Stripe

We take it from there

-

A refund transfer is not a loan. It is a banking service that allows your tax preparation fees to be deducted from your refund after the IRS or state issues payment.

Process overview:

You complete the intake and submit all required documentation.

Your return is prepared and electronically filed upon payment arrangement selection.

The IRS or state sends your refund to a temporary bank account established by the refund transfer provider.

Approved tax preparation fees and applicable bank fees are deducted.

The remaining refund balance is deposited into your chosen bank account or prepaid card.

-

Once all documents are submitted and payment is completed:

Individual returns → 1–3 business days

Self-employed & business returns → 1–5 business days

During peak tax season, timelines may extend slightly, but communication is always provided.

-

Yes. Expedited service may be available for an additional fee, based on workload and complexity. Availability is confirmed after intake review.

Need more information? Click the FAQ button below.